IRB Infrastructure Developers Ltd (IRB Infra) is a key player in the Indian infrastructure sector which develops roads and highways by using the Build-Operate-Transfer and Hybrid Annuity Model contract. One has to evaluate industry growth trend and company specific performance metrics and broader macroeconomic indicators to forecast intended share price target of IRB to 2030. This analysis offers a strategic view to market enthusiasts and investors.

Key Details About IRB Infra

| Parameter | Details |

|---|---|

| Industry | Infrastructure Development |

| Founded | 1998 |

| Headquarters | Mumbai, Maharashtra, India |

| Stock Listings | NSE & BSE |

| Ticker Symbol (NSE) | IRB |

| Market Position | BOT road infrastructure developer |

Stock Price Targets

| Year | Minimum Target (₹) | Maximum Target (₹) |

|---|---|---|

| 2025 | 60.30 | 117.00 |

| 2026 | 77.40 | 95.75 |

| 2027 | 86.40 | 110.37 |

| 2028 | 95.18 | 123.01 |

| 2029 | 98.62 | 137.18 |

| 2030 | 103.58 | 282.00 |

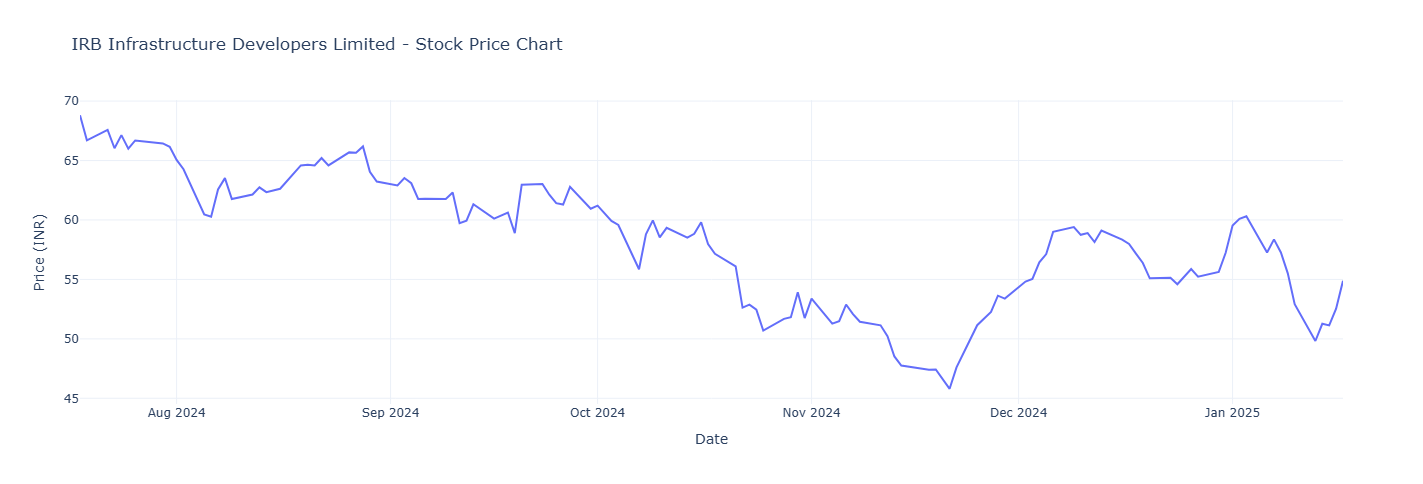

IRB Infrastructure Developers Limited (IRB.NS)

| Stock Symbol | Company Name | Current Price | 52-Week High | 52-Week Low | Market Cap |

|---|---|---|---|---|---|

| IRB.NS | IRB Infrastructure Developers Limited | 54.88999938964844 | 78.15 | 45.06 | 331480694784 |

IRB Share Price Target for 2030

Expected Target Price Range: 104 – 283 INR

Analysis:

- Revenue Growth: Operational assets for stable cash flow, increasing collections from tolls, and new project launches.

- Government Initiatives: The benefits of National Infrastructure Pipeline (NIP) and Bharatmala Pariyojana projects.

- Debt Reduction: Improving the debt to equity ratio, cutting down on the interest costs and get higher profitability.

- Technological Advancements: Digital tolling systems and operational efficiencies.

- Environmental Sustainability: Been able to attract investments through eco friendly projects.

Factors affecting IRB Infra’s Share Price.

1. Sectoral Growth:

Coming up from the bottom, there is growing investments in roads, highways and urban developments in India’s infrastructure. As a leader in this space, IRB Infra is going to benefit significantly.

2. Project Pipeline:

IRB’s revenues and confidence will increase with completion of current projects and win contract. That help from the government enhances its market place.

3. Economic Indicators:

This will positively influence the performance of the company by changing GDP growth, controlling inflation and good interest rates.

4. Competitive Landscape:

Long term growth will depend on IRB Infra’s capacity to continue to lead in securing high value contracts.

Why IRB Infra May Outperform

- Diversified Portfolio: IRB’s projects focus area are highways, bridges and tunnels, thus eliminating the reliance on a single revenue source.

- Strong Earnings: It is expected to be profitable from consistent revenue from tolls and asset monetization.

- Partnerships: Project execution efficiency is made simpler by collaborating with government agencies and private players.

Pingback: Polycab Share Price Target for 2025 - Bullish Insights - Tech Venture Spot