BLT Logistics IPO: GMP, Subscription Status, and Analysis

The BLT Logistics IPO GMP is at 15 per share as of August 6, 2025, a range that shows that the company will be seen to be listing at approximately 90 on August 11, 2025.

Its price was determined at a cost of 75, and its subscription strength at the rate of 7.53 times by the 2nd day indicates a high demand among the investors. All the information you need is below: GMP trends, IPO price range, important dates, lot size, subscription position as of today, and imperative insights to enable you to make an informed decision as to whether to take part in it.

BLT Logistics IPO Overview

BLT Logistics is an SME offering an IPO of 1,296,000 equity shares of face value (10 rs) to raise up to 9.72 crores. It is a freight management, warehousing, and cold chain services company whose operations are important in the expanding logistics business in India.

Detailed Information

| Issue Size: | ₹9.72 Crores |

| Price Band: | ₹75 per share |

| Face Value | ₹10 |

| Lot Size: | 1,500 shares |

| Listing Date: | August 11, 2025 |

| Grey Market Premium (GMP): | ₹15 (as of Day 2) |

| Estimated Listing Price: | ₹90 |

Key Dates & Timelines

| IPO Opening Date: | August 4, 2025 |

| IPO Closing Date: | August 6, 2025 |

| Allotment Finalized: | August 8, 2025 |

| Refunds & Demat Credit: | August 9–10, 2025 |

| Listing on Exchange: | August 11, 2025 |

Understanding these dates helps you track allotment, refunds, and listing, ensuring you’re prepared for final settlement and potential listing gains.

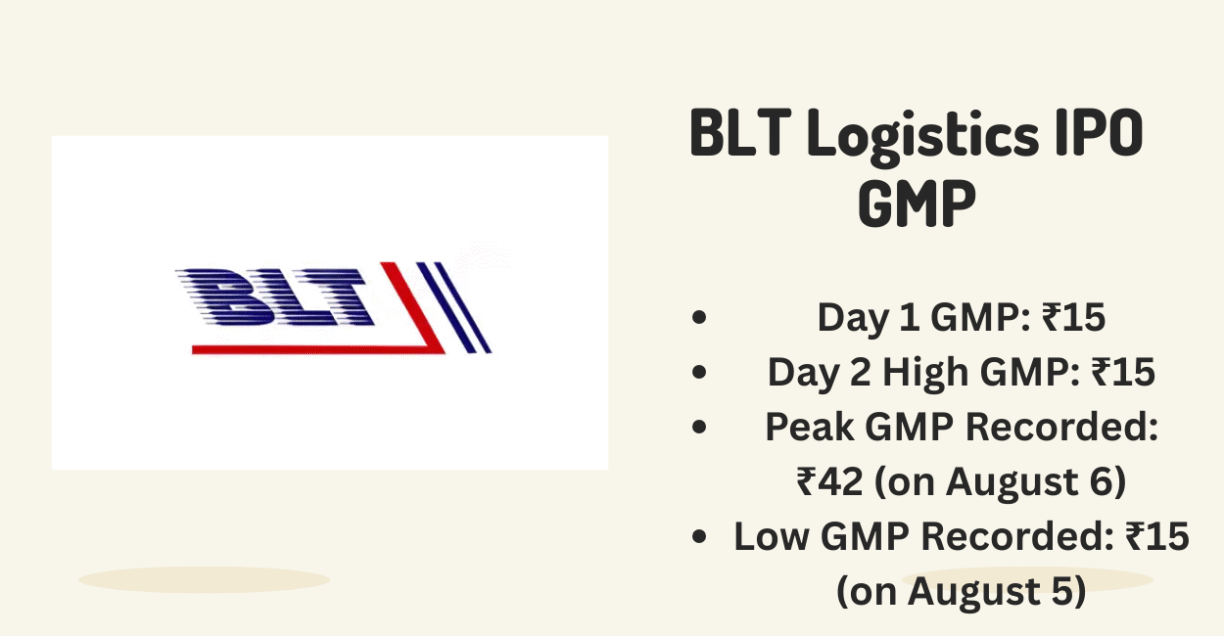

GMP Trends: Grey Market Premium Explained

The Grey Market Premium (GMP) indicates market sentiment by showing how much investors are willing to pay over the IPO price before listing. For BLT Logistics:

- Day 1 GMP: ₹15

- Day 2 High GMP: ₹15

- Peak GMP Recorded: ₹42 (on August 6)

- Low GMP Recorded: ₹15 (on August 5)

Why GMP Matters

- Reflects demand/supply ahead of listing

- Helps gauge potential listing gains

- Informs trading strategies on Day 1

Subscription Status Today

As of the latest data:

- Overall Subscription: 7.53× (over 7.5 times subscribed)

- Retail Portion: Fully subscribed within hours

- QIB Portion: Oversubscribed by 3×

- NII Portion: Oversubscribed by 5×

Such strong subscription across categories suggests high investor confidence in BLT Logistics’ fundamentals and growth prospects.

Why BLT Logistics IPO Subscription Status Is Important

- Market Sentiment Gauge: The subscription records show investors appetite in real time.

- Allotment opportunities: Subscription at a higher rate can reduce the allotment ratio of retail investors.

- Pricing Insights: A good subscription is usually associated with a good listing.

Price, Lot Size & Return Estimates

Issue Price

per share

Lot Size

shares (₹112,500 per lot)

Projected Gain

₹90 – ₹75 = ₹15 per share

Potential Return Scenarios

- Conservative Estimate: GMP stays at ₹15 → Listing at ₹90 → 20% gain

- Bullish Scenario: GMP rises to ₹20 → Listing at ₹95 → 26.7% gain

FAQs

A1: GMP is 15 rupees per share (Day 2 or August 6, 2025).

A2: GMP = Trading price in the grey market less the IPO price; it shows listing gains are expected.

A3: You have to buy 1,500 shares minimum (112,500). You may apply in multiples of this lot.

A4: You can apply through your broker’s online portal or UPI-enabled IPO application platforms by selecting the BLT Logistics issue, entering the number of lots (each lot = 1,500 shares), and confirming payment via UPI.

A5: SME IPOs carry higher liquidity risk, limited analyst coverage, and potential market volatility. Always review the company’s financial health, management track record, and use conservative allocation.

A6: Yes—most brokers allow you to modify or withdraw your bid before the IPO closing date (August 6, 2025). After allotment, changes cannot be made.

A7: Allotment details are typically finalized within two business days after the IPO closes (by August 8, 2025). Check your broker’s platform or the registrar’s website for updates.

A8: Yes—once BLT Logistics shares are credited to your demat account (by August 10), you can trade them on the exchange starting from the listing date (August 11, 2025), subject to market hours and volume.

A9: No—GMP indicates grey market sentiment but isn’t a guarantee. Market conditions on listing day, demand–supply balance, and broader market trends can influence actual listing price.