Spunweb Nonwoven IPO: A Detailed Analysis

A comprehensive survey note on the Spunweb Nonwoven SME IPO, covering its financials, subscription, market sentiment, and other key details for potential investors. This analysis is current as of July 15, 2025.

Key Highlights

Introduction and Background

Spunweb Nonwoven and its sister concern, Spunweb India Private Limited (SIPL), are recognized as the largest producers of polypropylene spunbond nonwoven fabric in India. The company, which began operations in 2015, is headquartered in Rajkot, Gujarat.

It serves a diverse range of industries, including hygiene (diapers, sanitary napkins), healthcare (face masks, PPE kits), packaging (shopping bags), agriculture (crop cover), construction, and home furnishing.

Company Overview and Operations

Spunweb Nonwoven manufactures a variety of specialized polypropylene spunbond nonwoven fabrics. These fabrics possess properties like being hydrophobic, hydrophilic, super soft, UV-treated, antistatic, and flame retardant.

Product Specifications:

- Weight Range: 7 to 150 GSM.

- Widths: 1.6 meter, 2.6 meter, and 3.2 meter.

- Customization: Available in over 20 colors with options for coating, slitting, printing, and cutting into sheets.

The company's factory in Rajkot, Gujarat, is equipped with three production lines, ensuring efficient production and scalability. This wide range of applications provides a stable and diversified demand for its products.

IPO Details at a Glance

| Attribute | Details |

|---|---|

| IPO Dates | July 14, 2025 - July 16, 2025 |

| Price Band | ₹90 - ₹96 per share |

| Lot Size | 1,200 Shares |

| Issue Size | ₹61 crore (Fresh issue of 63.52 lakh shares) |

| Listing On | NSE SME |

| Allotment Date | July 17, 2025 |

| Listing Date | July 21, 2025 |

| Book Running Lead Manager | Vivro Financial Services Private Limited |

| Registrar | MUFG Intime India Private Limited |

Price and Structure

The IPO is a book-building issue with a price band of ₹90 to ₹96 per share. The issue is structured to cater to different investor categories:

- Qualified Institutional Buyers (QIBs): 50%

- Retail Investors: 35%

- High Net-worth Individuals (HNIs/NIIs): 15%

Minimum Investment:

- Retail (Min): 2 lots (2,400 shares) = ₹2,16,000 (at upper price band)

- HNI (Min): 3 lots (3,600 shares) = ₹3,45,600 (at upper price band)

Allotment Procedure

The allotment will be finalized on July 17, 2025. For oversubscribed SME IPOs, a lottery system is typically used. Retail investors bidding for the minimum lot size have a chance to receive at least one lot. Investors can check their allotment status on the registrar's website or the stock exchange's portal.

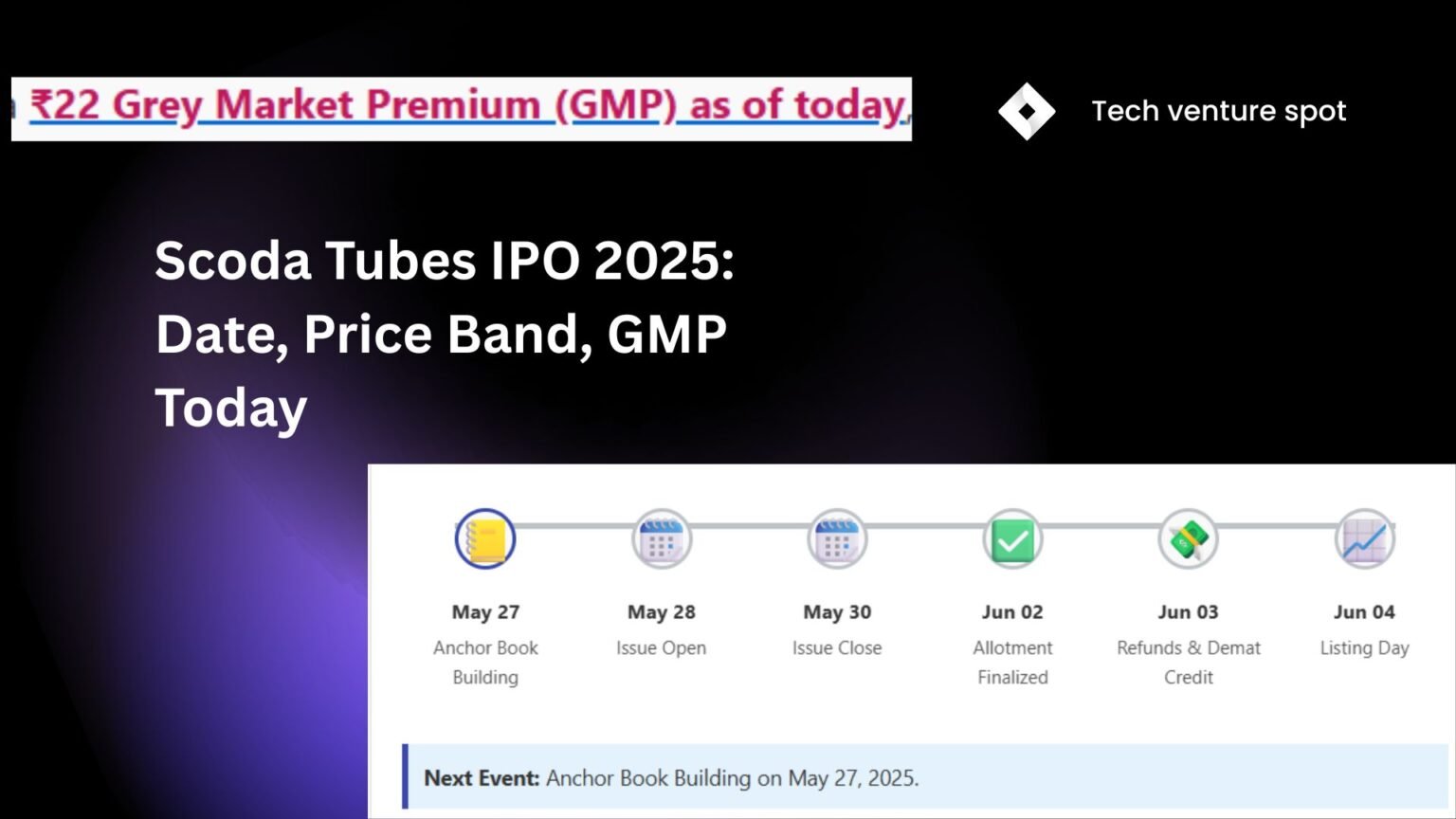

Grey Market Premium (GMP)

The Grey Market Premium (GMP) indicates strong pre-listing interest. As of July 15, 2025, the GMP stands at approximately ₹42, suggesting a potential listing price of ₹138 per share—a premium of 43.75% over the upper price band.

The GMP has shown volatility, moving from ₹16 on July 11 to ₹42 by July 15, reflecting growing positive sentiment. It's important to remember that GMP is an unofficial indicator and not a guarantee.

Subscription Status

The IPO has received a robust response from investors, being subscribed 15.60 times overall by the end of Day 2 (July 15, 2025). The strong oversubscription, especially from retail and NII segments, signals high investor confidence.

Subscription Details (Day 1 - July 14, 2025)

- Overall: 7.61 times

- Retail: 11,408 bids for 2,73,79,200 shares.

- NII: 880 individuals sought 72.36 lakh shares.

- QIB: No bids on Day 1, which is common as institutions often invest on the last day.

The final subscription figures show 6.58 crore shares subscribed against an offering of 42.21 lakh shares.

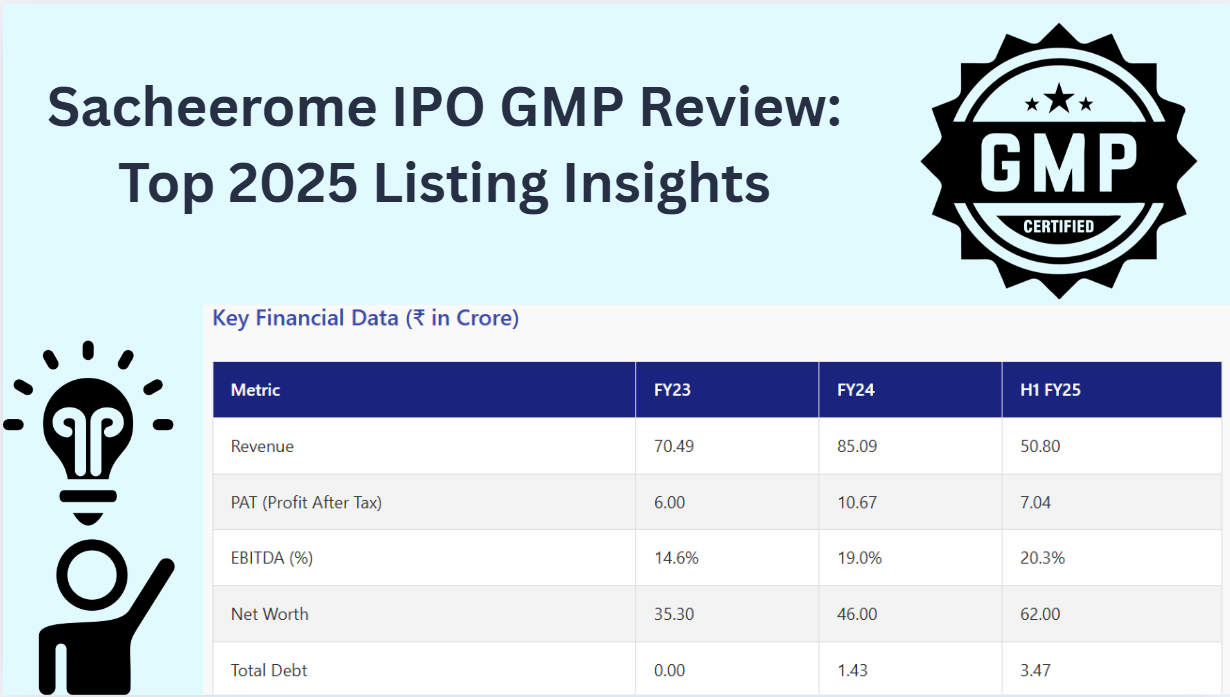

Financial Performance

Spunweb Nonwoven's financials are a key attraction for investors, showcasing significant growth and profitability. The funds from the IPO will be utilized for working capital, investment in SIPL, and debt repayment.

| Financial Metric (FY25 vs FY24) | FY24 | FY25 | Growth |

|---|---|---|---|

| Revenue | ₹154.24 crores | ₹227.14 crores | +47% |

| Profit After Tax (PAT) | ₹5.44 crores | ₹10.79 crores | +98% |

| EBITDA | Nearly doubled, indicating improved operational efficiency. | ||

These figures, as reported by sources like The Economic Times and IPO Watch, underscore the company's strong growth trajectory and potential for long-term value creation.

Hot News and Social Media Buzz

The IPO has generated significant discussion on social media platforms like X (formerly Twitter). Influencers and market analysts have been actively posting updates.

@GuruShareMarket & @bsindia: Highlighted the strong subscription numbers (12x to 15.60x) and a healthy GMP range of 36% to 43%, signaling positive investor sentiment.

@HeTalksFinance: Recommended applying for the IPO for potential listing gains, while also issuing a standard caution on the inherent volatility of SME stocks.

@ChintanParikh10: Reported on a live Q&A session with the company's Managing Director, which provided investors with deeper insights into operational strategies and future plans.

Conclusion and Investment Considerations

The Spunweb Nonwoven IPO presents a compelling opportunity for investors interested in the high-growth SME sector. However, a balanced view is essential.

Key Positives:

- Robust Subscription: Oversubscribed 15.60x, indicating high demand.

- Healthy GMP: A premium of over 40% suggests a strong listing.

- Impressive Financials: Revenue and profit growth of 47% and 98% respectively.

- Diversified Product Application: Reduces dependency on any single industry.

Points of Caution:

- SME IPO Risks: SME stocks are generally more volatile and less liquid than mainboard stocks.

- Low Initial QIB Interest: Lack of QIB participation on Day 1, though not unusual, is a point to note.

- Market Volatility: GMP is speculative, and the final listing price depends on market conditions on the listing day.

Investors should conduct their own due diligence and consider consulting a financial advisor. While the IPO appears poised for a premium listing based on current data, past performance is not indicative of future results.