Important Updates of the Release of Voyager Technologies IPO

A scarce opportunity to invest in a company with a 100% mission success rate over 17 years. Voyager is pioneering complex cislunar and GEO missions, signaling a new era in space exploration.

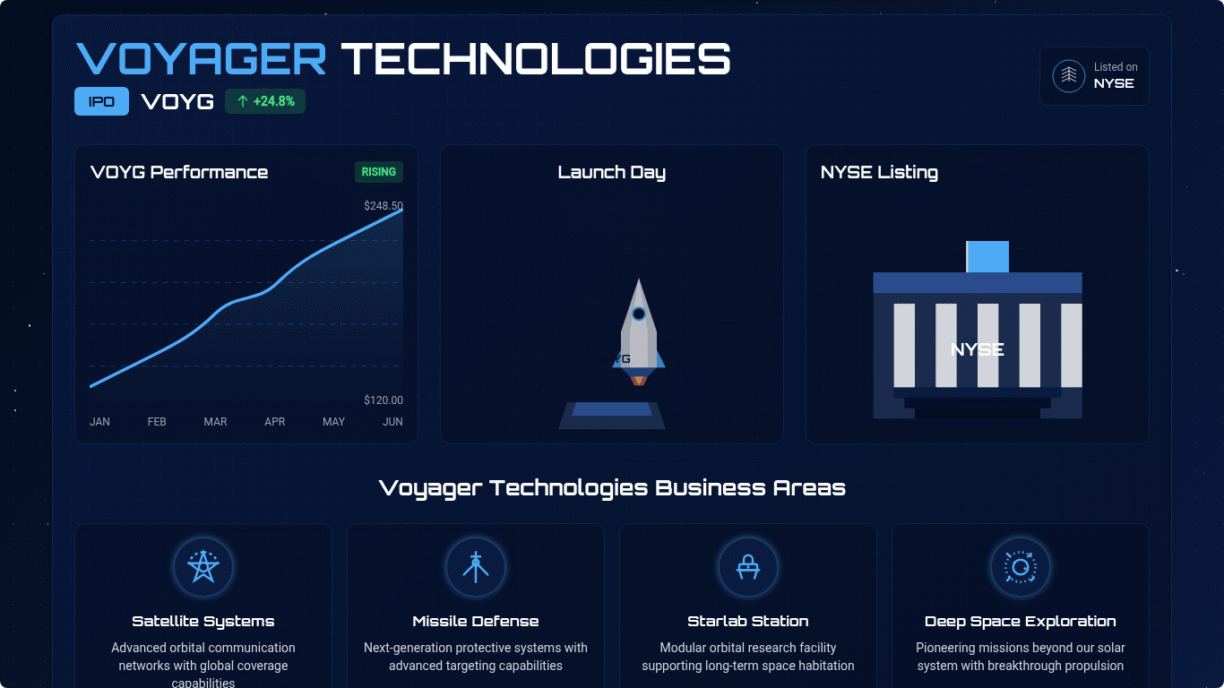

Investors showed strong enthusiasm, with VOYG's stock surging 82% on its debut day, highlighting rising interest in commercial space and defense technology.

For quick navigation: Company Overview | Market Performance | Analyst Views

IPO Quick Facts

| Attribute | Details |

|---|---|

| IPO Date | Debuted on June 11, 2025 |

| IPO Price | $31.00 per share |

| Offering Shares | 14,200,645 (up to 28,401,290 including over-allotment) |

| Total Proceeds | Approximately $402.3 million |

| Ticker & Exchange | VOYG on the New York Stock Exchange (NYSE) |

| Lead Managers | Morgan Stanley, J.P. Morgan, Barclays, Jefferies, BofA Securities, KeyBanc, and Wolfe |

| IPO Valuation | ~ $1.9 Billion |

Use of Proceeds

Research & Development

Fueling the next-generation of space and defense technology.

Innovation Capital

Investing in long-term capital assets for future innovations.

Mergers & Acquisitions

Pursuing prospective M&A opportunities in core business segments.

General Corporate Purposes

Repayment of debts, system upgrades, and working capital.

Company Overview

Established

October 2019, through a merger with Voyager Space Holdings. Headquartered in Denver, Colorado.

Track Record

Over 500 customers, 1,200+ missions, and a 100% non-failure record on spacecraft technology since 2006.

Starlab Partnership

A joint venture with Airbus and Mitsubishi. Starlab is a potential successor to the ISS for microgravity R&D, with backing from NASA.

Business Segments & IPO Strategy

A Commitment to Long-Term Growth

Voyager's choice of a traditional IPO over a SPAC is a significant indicator. This strategy signals a focus on long-term stability and sustainable growth in the often tumultuous space technology sector.

Core Segments:

- Defense and National Security

- Space Solutions

- Starlab Space Stations

Market Performance

Debut Day Surge

The stock closed its first day of trading at $56.48, a remarkable 82% increase from its IPO price. This surge clearly demonstrates strong investor confidence in Voyager's vision and capabilities.

Post-IPO Trading

Following the initial excitement, the stock has settled into a trading range between $50 and $60. This reflects a balance between investor exhilaration and cautious analysis of its valuation, which sits at a roughly 20x deal sales multiple.

Analyst Views

Bullish Outlook

Analysts are optimistic due to the massive growth potential in the space technology and national security sectors. Voyager's established track record and strategic partnerships position it as a key player in these expanding markets.

Bearish Concerns

Skeptics point to the high cash burn rate relative to current revenue. The company's high valuation is a key concern, with success heavily dependent on flawless execution and avoiding delays in major projects.