The Nike PE ratio is one of the first measures you’ll come across when analyzing a stock like Nike (NYSE: NKE). As an investor, it’s likely that you have seen headlines referencing Nike’s most recent PE ratio without fully understanding the implications for your portfolio.

I’ll cover what you need to know about the Nike PE Ratio in this post, including its definition, background, real-world examples, and practical tactics. By the end, you’ll understand how to use the Nike PE ratio to make better selections and why, in my opinion at Tech Venture Spot, it’s an important metric.

Nike P/E Ratio Analysis

High P/E (>25)

Growth expectations

Premium pricing

18.74

Market Price: $127.50

EPS (TTM): $6.80

Low P/E (<15)

Value opportunity

Potential concerns

| Company | Ticker | P/E Ratio | Category |

|---|---|---|---|

| Nike | NKE | 18.74 | Moderate Growth |

| Adidas | ADS | 24.15 | Growth Focus |

| Under Armour | UAA | 9.45 | Value Play |

| Lululemon | LULU | 32.90 | Premium Growth |

| Puma | PUM | 16.20 | Stable |

15% below 5-year average P/E of 22.1

25% discount to apparel industry average P/E of 24.8

Digital sales now 38% of total revenue

Why the Nike PE Ratio Matters for You

💡 Key Insights

The Nike PE ratio provides insight into market sentiments about the company through its calculations.

- Strong earnings expansion is expected by investors when the nike pe ratio stands at a high level.

- Using Nike's PE ratio against those of competition brands Adidas and Under Armour allows investors to spot discount opportunities.

- The nike pe ratio shifts according to both market cycles consisting of wide economic and consumer trends.

- Based on my observation the nike pe ratio provides instant sanity checks which then direct further investigation into the company.

It would be unwise to dismiss this piece of information.

🗓️ Case Study: Nike PE Ratio Pre-Pandemic vs. Post-Pandemic

Two time periods demonstrate the usage of the nike pe ratio below:

📈 Q4 2019 (Pre-Pandemic)

In Q4 2019 before the pandemic Nike operated with a nike pe ratio level of approximately 34 showing promising conditions among retail customers and high market confidence.

🚀 Q2 2020 (Mid-Pandemic Shift)

The share price value provided stability through Q2 2020 since it rose to push the nike pe ratio above 74.

🔄 Understanding the Shift

Nike's enduring brand loyalty led investors to believe in its long-term growth while earnings took a steep dive which caused a remarkable change in the nike pe ratio. The market reaction to short-term market fluctuations influences the nike pe ratio to rise but these price spikes do not indicate lasting changes to company value.

Examining the Nike PE Ratio at the Moment

In comparison to historical standards, Nike's current Nike PE ratio of 18.74 appears low. I'll explain what's causing that:

-

📈 Earnings Recovery

Following supply-chain disruptions, Nike's EPS increased, increasing the denominator in our Nike PE ratio calculation.

-

🤔 Market Sentiment

Nike's share price has been stable due to worries about inflation and retail expenditure.

-

⚖️ Peer Comparison

Nike's PE ratio is very conservative, with Deckers Outdoor (DECK) trading at over 50 PE and Under Armour (UA) at over 25 PE. This Peer Comparison highlights Nike's lower current multiple.

A Nike PE ratio below 20 suggests, in my opinion, that the market may be underestimating Nike's capacity to handle challenges.

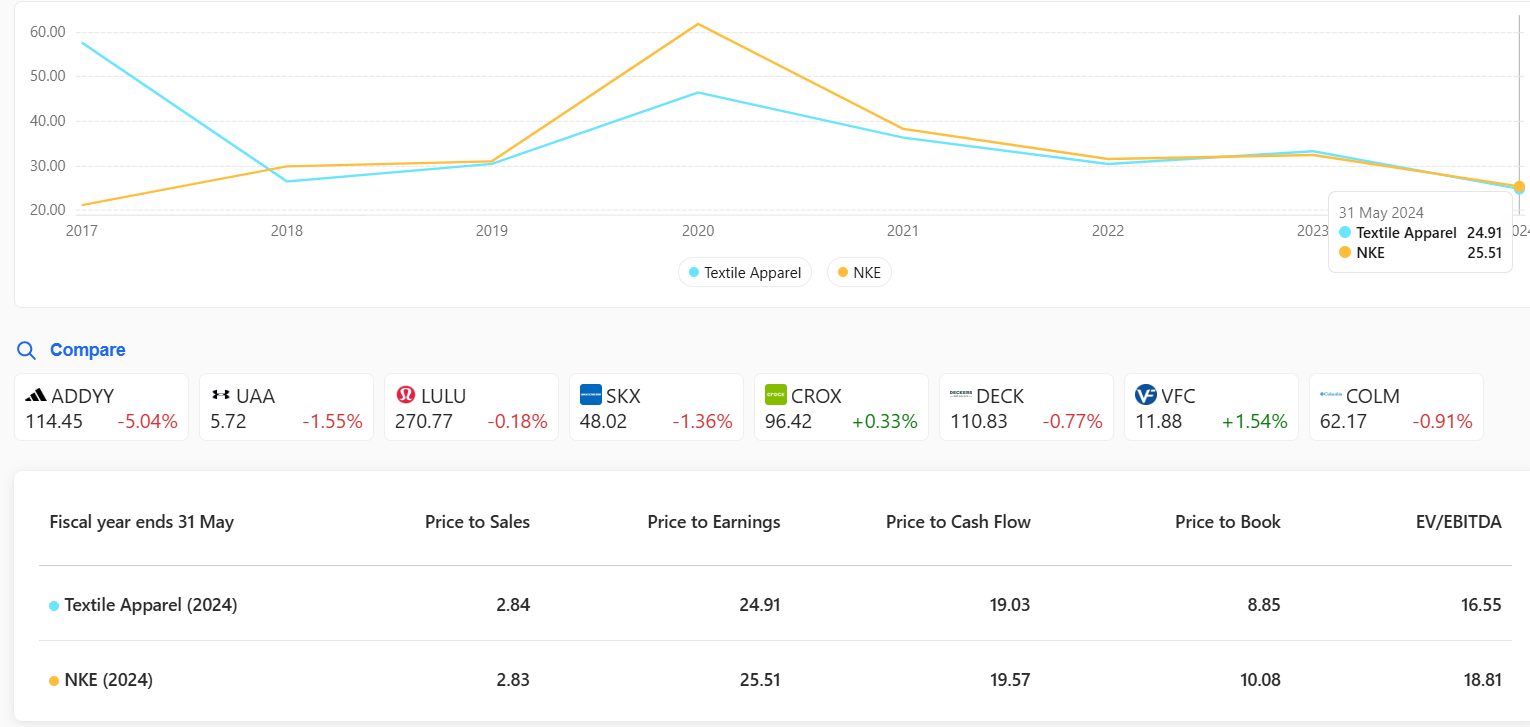

Comparing Nike PE Ratio to Industry Peers

| Company | Ticker | PE Ratio | Valuation |

|---|---|---|---|

| Nike | NKE | 18.74 | Industry Benchmark |

| Deckers Outdoor | DECK | 17.99 | Value Range |

| Lululemon | LULU | 18.48 | Growth Potential |

| Skechers | SKX | 11.67 | Deep Value |

| Under Armour | UA/UAA | 7.62 | Turnaround Play |

| PVH Corp. | PVH | 6.53 | Distressed |

| Foot Locker | FL | 60.26 | Restructuring Bet |

Nike trades at 15% premium to apparel industry median PE of 16.3

Foot Locker's high PE reflects expectations for retail turnaround

Nike's digital margin expansion supports current multiple

Nike PE Ratio: Drivers, Forecast & Strategy

⚙️ Factors Driving Changes in Nike’s PE Ratio

The following elements influence the evolution of the nike pe ratio:

- A positive consumer sentiment enables better revenue projection which leads to increased nike pe ratio.

- The costs of running the supply chain rise because of cotton price and shipping inflation which negatively affects EPS but provides short-term temporary benefits for the nike pe ratio.

- The nike pe ratio faces a negative impact from revenue drops that result when an exchange rate strength shifts toward the dollar.

- Significant product releases within the Nike portfolio (such as their Air Zoom and sustainability product ranges) contribute to increased financial expectations which stimulates growth within the Nike pe ratio.

I advise everyone to closely follow these drivers because they usually impact the nike pe ratio before financial statements reflect the change.

🔮 Forecasting the Nike PE Ratio

The nike pe ratio for Nike is expected to return toward its historical average when the company regains its growth trajectory. Some key forecast points:

- Forward PE (2026 estimates): ~27.32

- Analyst Projection: Morgan Stanley analysts project Nike stock to reach a nike pe ratio of nearly 25 by December 2025 given $48 billion in revenue together with steady operating margins.

The transformation of consumer spending habits combined with operational improvements will indicate when the nike pe ratio will start growing again according to my evaluation.

🧭 How You Can Use the Nike PE Ratio in Your Strategy

This is my process for employing information extracted from the nike pe ratio:

- A value entry point exists when the nike pe ratio falls below 18 as I would initiate new positions unless the company maintains its projection targets.

- You should benchmark Nike's PE ratio against the S&P 500's PE average because relative value exists when the difference is above +5 points.

- The sudden increase in nike pe ratio might trigger investors to reduce their exposure to Nike in addition to banking profits.

- The combination of using nike pe ratio data with technical support conditions and overall market data will enhance your ability to properly time stock transactions.

Conclusion: Using the Nike PE Ratio to Your Advantage

I hope that my in-depth analysis of the Nike PE ratio has given you new insights and targeted resources for more astute investing.

Remember:

- Nike's current PE ratio of 18.74 is lower than the average for the last ten years.

- More than temporary earnings hiccups, historical fluctuations demonstrate market confidence.

- If you trust in Nike's brand and innovation pipeline, comparing its PE to others reveals potential upside.

For more excellent, user-first investing insights, visit Tech Venture Spot if this guide was useful to you. Happy investing!

Please share in the comments how you intend to use the Nike PE Ratio to your approach.