Introduction

As an investor, I constantly monitor companies in emerging semiconductor sector, and Moschip Technologies has taken my notice. Given that it’s growing steadily in semiconductor and IoT, you wish to recognize the Moschip stock history current trends to be able make smart investment decisions and future forecasts. In this post, I will evaluate Moschip share Price, strengths and weaknesses, and if now is the time to buy Moschip shares.

Moschip Share Price History

| Year | Opening Price (₹) | Closing Price (₹) | Annual Change (%) |

|---|---|---|---|

| 2020 | 18.50 | 24.75 | +33.8% |

| 2021 | 24.75 | 34.20 | +38.2% |

| 2022 | 34.20 | 42.10 | +23.1% |

| 2023 | 42.10 | 56.30 | +33.8% |

| 2024 | 56.30 | TBD | TBD |

Key Observations:

- Consistent Increase: Moschip’s stock has consistently appreciated over the last few years.

- Industry Trend Inflation: The stock has been a good responder to the semiconductor industry trends and rapid adoption scenario of IoT.

- Volatility is a Fact: Given that Moschip is a tech stock, the company has faced their share of ups and downs, particularly when the market is down.

- Moschip Technologies Ltd. (MOSCHIP), is an Indian Semiconductor company, which designing, developing and marketing of integrated circuits (ICs) and embedded solutions. The firm’s products are utilized in items, that are utilized in industry of consumer electronics, industrial automation, and automobile.

Moschip Share Price Performance

As of February 16, 2025, Moschip share price is Rs.175.25 NSE and Rs.175.35 BSE. In the recent months the stock has been showing volatile nature with the 52-week high of Rs 208 and 52-week low of Rs 163.2.

Factors Driving Moschip Share Price

Many things are influencing Moschip share price, such as:

- Semiconductor sector to experience a strong growth: Semiconductor industry is predicted to register 10.8% CAGR from 2024 to 2030.

- Moschip good financial performance: Moschip has a good record of financial performance. Revenue of the company has risen at CAGR of 28 per cent over the past three years. There is also improvement in Moschip profitability.

- Moschip net profit margin has risen from 2.44% in 2021 to 8.77% in 2024.

3. Moschip forward strategies: Moschip is concentrating on several forward strategies to improve the business growth, including expanding product portfolio, research and development spend and infrastructure establishment globally.

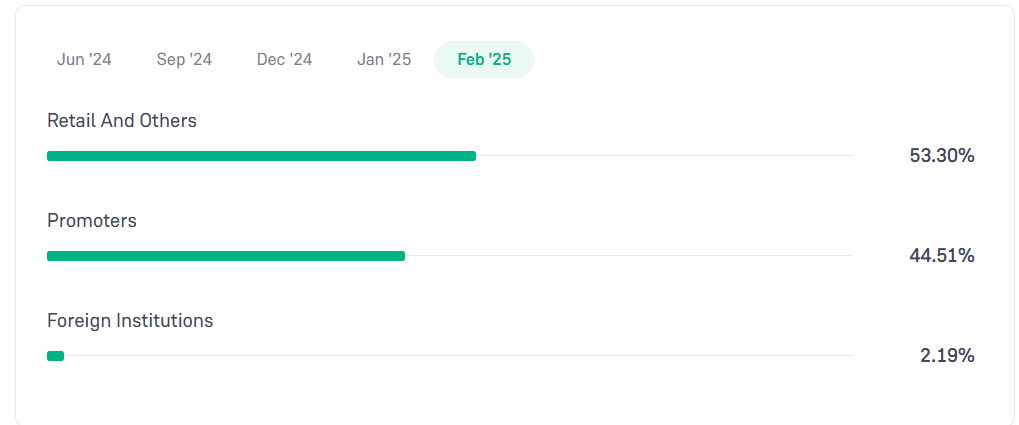

Moschip Technologies Shareholding Pattern

Moschip Share Price Forecast

Analysts are optimistic about Moschip share price with consensus target close to Zero levels ₹250. This target price brings an upside of more than 40% over the present market price.

Risks to Moschip Share Price

There are also some risks in the Moschip share price of the bearer, such as.

- Competition: Semiconductor industry is a highly competitive one. Moschip is competing with a number of the large and well-positioned companies.

- Technology: The semiconductor industry is on a perpetual upgrade. Moschip has to stay in line with the latest technological developments in order to remain competitive.

- Economic situation: The global economy is at present experiencing a lot of problems such as inflation and interest rates increases. This trend may have an adverse effect on Moschip operations.

MosChip Share Price Drivers

1.Industry Growth:

- The global semiconductor market will go up by CAGR of 10.8% during 2024 to 2030.

- This growth is mainly attributed to growing demand for semiconductors in various applications including consumer electronics, automotive as well as industrial automation.

2.Financial Performance:

- MosChip has a good financial history, posting revenue that has grown by 28% in CAGR over the past three years.

- Additionally, its profitability stood up very well.

3.Strategic Initiatives:

Moschip is pursuing a number of strategic initiatives to drive growth, such as expanding its product portfolio, investing in research and development, and expanding its global presence.

Moschip Share Price Analysis & Feature Prediction

| Factor | Data (Latest Quarter) |

|---|---|

| Revenue Growth | 30.16% YoY |

| Net Profit Margin | 8.77% |

| EPS (Earnings Per Share) | ₹0.33 |

| P/E Ratio | 154.87 |

| Debt-to-Equity Ratio | 0.16 |

| Indicator | Data |

|---|---|

| 50-Day Moving Average | ₹192.9 |

| 200-Day Moving Average | ₹203.6 |

| RSI (Relative Strength Index) | 45 (Neither Overbought nor Oversold) |

| MACD Indicator | Showing bearish momentum |

Future Prediction

Going by fundamental and technical perspective, Moschip share price could reach ₹ 220-250 in the next 6-12 months, provided there is revenue growth following the same trend and favorable market conditions. However, investors need to keep in mind bigger macro themes, things that affect Globally Semiconductor chain disruptions.

Disclaimer: Please don’t take this as investment advice offering. Please make your own research before buying in any stock.

Is Buying Moschip Shares a Good Investment?

| Pros | Cons |

|---|---|

| Strong financial performance & revenue growth | High volatility in the semiconductor industry |

| Benefiting from India’s semiconductor initiatives | Competition from global semiconductor giants |

| Growing demand for IoT and embedded solutions | External risks such as supply chain disruptions |

Latest Moschip Stock News

For to stay up to date with Moschip stock news, investors should monitor:

- Earnings Reports: Moschip Q4 Financial Performance Reports

- Industry Trends: Developments in semiconductor and IoT sectors

- Regulatory Changes: Government policies related to the semiconductor industry

Final Thoughts

Would I Invest?

Yes, I am positive on coming on board Moschip under my portfolio, but with my investment will I may also invest other business to reduce risk.

Disclaimer: This publication is for informational purposes only and is not a financial advice. Notices are informational and not intended as an offer to sell, or the solicitation of any offer to buy, nor is it a recommendation for or an offer to produce, exchange or sell, or purchase any security, investment, transaction or related activity. Always research by yourself or consult a financial advisor before investment.

Pingback: 7 Key Indicators to Monitor Paytm Share Price

Pingback: Apollo Micro Systems Share Price – Live Updates & Trends

Pingback: Best Penny Stocks for Long-Term Growth | Expert Picks