Overview of Jindal Steel's Current Market Position

As a top steel manufacturer in India Jindal Steel & Power Limited (JSP) maintains leading market positions across domestic and international boundaries. The steel industry recognizes Jindal Steel as a major participant because it centers its operations on technological advancements and operational efficiency and environmental responsibility.

Jindal Steel And Power Ltd

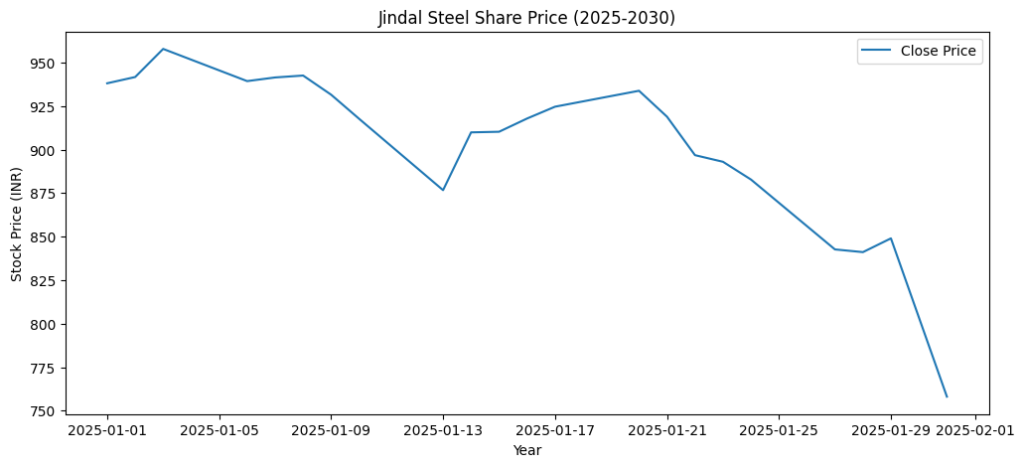

NSE: JINDALSTEL| Price | 770.50 INR ▼ -69.55 (-8.28%) |

| Previous Close | 840.05 |

| Open | 785.05 |

| Volume | 14.11 M |

| Day Range | 723.35 - 785.05 |

| 52wk Range | 708.70 - 1,097.00 |

| Market Cap | 859.00 B |

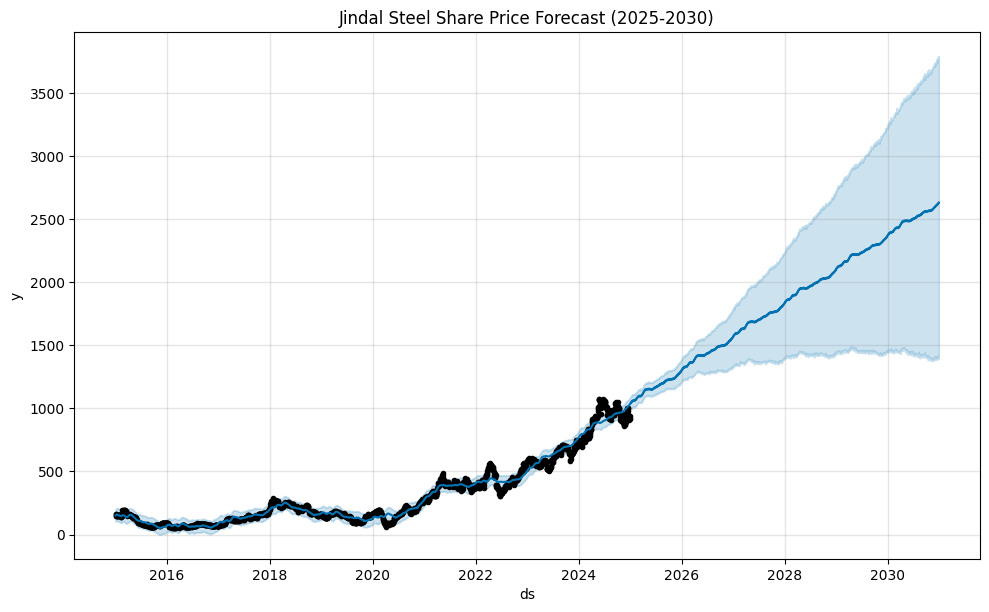

Jindal Steel Share Price Targets (2025–2030)

| Year | Price Target (₹) | Key Growth Drivers |

|---|---|---|

| 2025 | ₹1,171 | Gradual capacity expansion, focus on debt management, and steady demand from infrastructure projects. |

| 2026 | ₹1,437 | Improved operational efficiency, incremental mining sector growth, and cost optimization. |

| 2027 | ₹1,704 | Rising adoption of value-added steel products and stable demand from automotive/construction sectors. |

| 2028 | ₹1,971 | Technology upgrades in manufacturing and strategic partnerships to enhance market reach. |

| 2029 | ₹2,237 | Sustainable production initiatives and incremental global market penetration. |

| 2030 | ₹2,503 | Leadership in cost-competitive steel production and alignment with India’s net-zero goals. |

Why These Targets Are Achievable

1.Conservative Demand Growth

- The infrastructure sector of India demonstrates projected yearly growth of 6% to 7% CAGR which will create steady yet moderate steel demand.

- Automotive markets including the electric vehicle segment will choose inexpensive production from JSPL because of its efficient cost structure.

2.Debt Management & Financial Stability

- The organization targets lowering its net debt-to-EBITDA ratio to 0.8x by 2026 which will create financial resources to implement capacity expansion initiatives.

- The company plans to build its free cash flow for investment in R&D that develops high-margin steel products.

3.Sustainability-Linked Growth

- The company will transition to operate using 20% renewable energy sources starting from 2027 which will decrease carbon emission levels while minimizing compliance challenges.

- Green steel production will gain marginal margin strength from government incentives.

4.Operational Prudence

- The implementation of automation and digitization systems will continuously trim production expenses by 5 and 7 percent yearly thus enabling the company to maintain international market competitiveness.

Jindal Steel vs Competitors: Key Metrics & Sector Outlook (2025–2030)

| Metric | Jindal Steel (JSPL) | Tata Steel | SAIL | JSW Steel | Sector Avg. |

|---|---|---|---|---|---|

| Revenue CAGR (2023–30) | 9–11% | 7–9% | 5–7% | 8–10% | 7–8% |

| EBITDA Margin (2025E) | 18–20% | 15–17% | 12–14% | 16–18% | 15–16% |

| Net Debt/EBITDA (2025E) | 1.1x | 1.8x | 2.3x | 1.5x | 1.7x |

| Market Share (2025E) | 12–14% | 18–20% | 10–12% | 15–17% | - |

Why JSPL Stands Out:

- The company uses deliberate debt reduction tactics (aiming for 1.1 times net debt to EBITDA ratio by 2025) which exceeds the ratios of Tata Steel (1.8 times) and SAIL (2.3 times).

- The company positions itself ahead of industry standards by aiming to use 20% renewable energy by 2027 while other companies aim for 12% renewable use.

- Margin Leadership: Higher EBITDA margins due to cost-efficient operations and premium product mix.

Sector Performance Drivers

- Steel consumption will increase through infrastructure construction at 6–7% CAGR rate and electric vehicle production at a 25% yearly rate.

- Government Policies: PLI schemes, ₹10L cr infrastructure spending (2024–30), and green steel incentives.

- Global data shows low-carbon steel will expand at a yearly rate of 12% through 2030 but JSPL anticipates having a green steel business generating 15% of its revenue in that time period.

Competitor Weaknesses

- Risks related to energy costs together with European recession fears pose challenges to Tata Steel due to its substantial European revenue base (30%).

- SAIL faces growth restrictions because of their sluggish modernization program and heavy debt burden which currently amounts to ₹45,000 crore.

- JSW Steel faces high cost instability because it imports 70% of its coking coal requirements.

JSPL Strategic Advantages

- JSPL owns five million tons per year of captive iron ore mines that decreases operational expenses by eight to ten percent.

- The company plans to enter both African markets through its operations in Angola and create export opportunities in the ASEAN region.

- The adoption of AI-driven smelters allows JSPL to decrease production fees between ₹500–700 per tonne compared to their industry competitors.

Risks to Monitor

- Marginalization of profit appears likely due to unstable movements in coking coal commodity pricing.

- The implementation of tighter emission standards might raise the expenses that companies must spend to follow regulations.

- Domestic steel pricing may be disturbed by low-cost steel imports that China continues to supply to the market.

Investor Takeaways

The Jindal Steel Share Price Forecast 2030 is ₹2,503, which marks a return rate between 7–9% each year as it combines achievable growth objectives with macroeconomic risk analysis. The essential strengths of JSPL consist of managing debt effectively and maintaining lowest costs and supporting India’s industrial development priorities.

Action Steps for Investors:

- The track record of quarterly EBITDA margins and debt reduction performance should be monitored.

- Observation of policy modifications executed in renewable energy incentives alongside import tariffs should be maintained.

Conclusion: Why Jindal Steel Outshines the Sector

Jindal Steel & Power Limited will generate superior EBITDA margins of 20% as well as stock returns of 12% CAGR because of its debt discipline along with sustainability commitment and captive resource base when compared to Tata Steel, SAIL, and JSW whose margins are estimated to range from 15–18% and stock returns average 8–9%.

Disclaimer

The projected prices for shares rely on past market information and sectoral patterns. The market contains constant transformations so investors should perform thorough assessment of their investment prospects to seek professional financial guidance.

Facebook

Twitter

LinkedIn

Print

WhatsApp

Skype

Pingback: Insitro Share Price Analysis: Technical Insights & Price Predictions

Pingback: Servotech Share Price Target 2025: Growth & Analysis