Top 10 Best it sectors stocks in India 2025 for long term

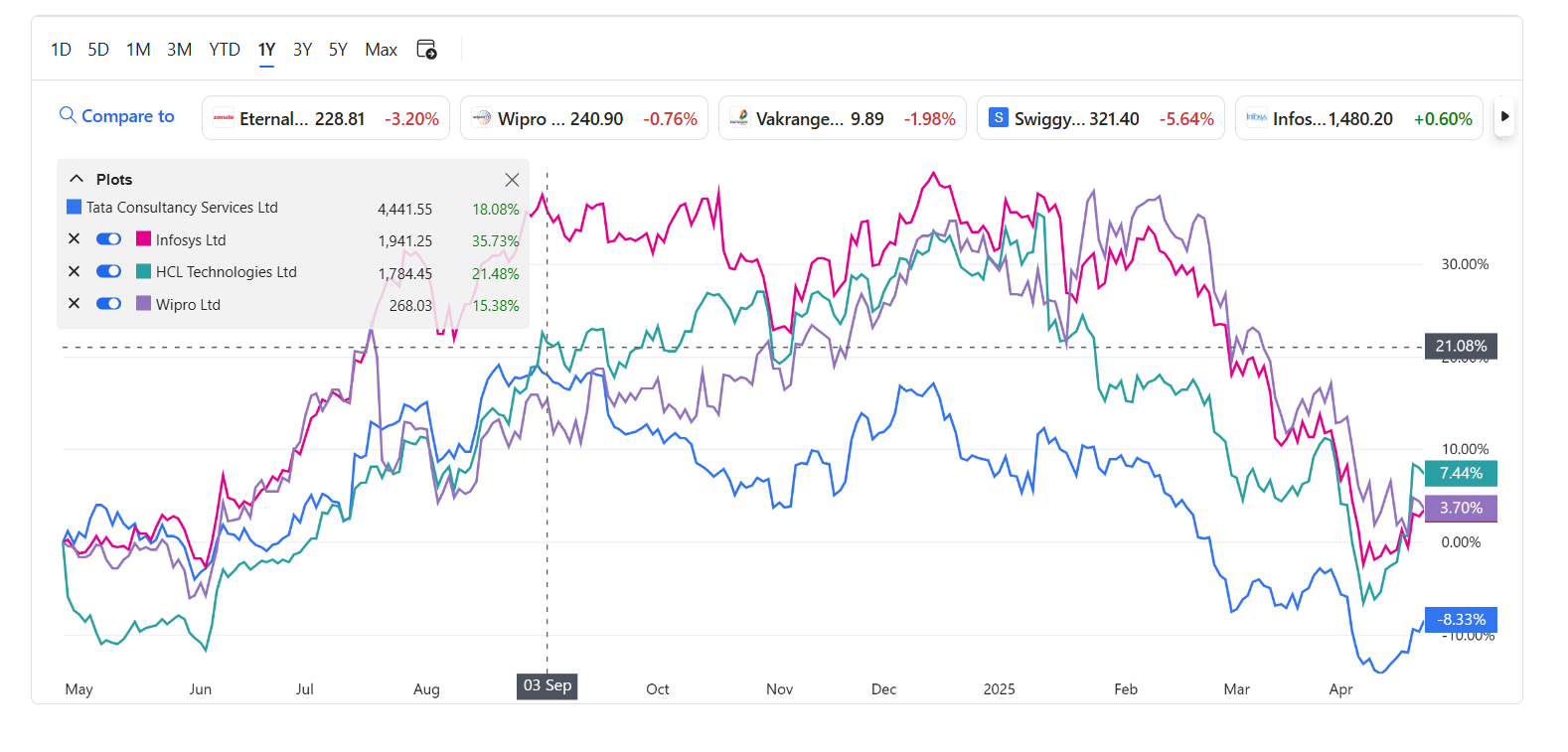

| Company | Price | Mkt Cap | Rev Gr | EPS Gr | ROE | D/E | FCF | Geo Mix | Digital Focus | Sector Trends | Analysis & Risk |

|---|---|---|---|---|---|---|---|---|---|---|---|

| TCS | ₹3,448 | 12.48L Cr | 7% | Moderate | 52.4% | 0.05 | Strong | US 65% EU 30% IN 5% |

Machine First™ Cloud Platforms |

AI Cloud |

✅ Strengths: Market leader, Strong cash flows ⚠️ Risks: Premium valuation, Telecom exposure |

| Infosys | ₹1,390 | 6.13L Cr | 4% | 5% | 20-25% | 0.04 | Robust | US 60% EU 35% IN 5% |

Infosys Nia AI Cloud Migration |

Cloud AI |

✅: High-margin products ⚠️: Wage inflation, Competition |

| HCL Tech | ₹1,578 | 4.28L Cr | 12% | 20% | 25% | 0.30 | Healthy | US 75% EU 20% IN 5% |

Digital Workplace Cybersecurity |

Cyber Cloud |

✅: IoT/5G deals ⚠️: Acquisition debt |

| Wipro | ₹241 | 2.52L Cr | 8% | 8% | 20% | 0.10 | Strong | US 60% EU 30% IN 10% |

Holmes AI EdgeVerve |

AI Cyber |

✅: Restructuring gains ⚠️: Slow historical growth |

| TechM | ₹1,000 | 3.10L Cr | 9% | 15% | 30% | 0.30 | Strong | US/EU 70% IN 20% |

5G Networks Enterprise Solutions |

AI 5G |

✅: Telecom leadership ⚠️: Capex cyclicality |

| LTIMindtree | ₹6,300 | 12.79L Cr | 20% | 25% | 25% | 0.02 | Very Strong | US 70% EU 20% IN 10% |

Cloud Transformation Data Analytics |

Cloud AI |

✅: Merged entity strength ⚠️: Integration risks |

| Mphasis | ₹1,600 | 46,000 Cr | 10% | 15% | 25% | 0.15 | Strong | US 80% EU 15% IN 5% |

GenAI Cloud Apps |

Cloud Cyber |

✅: BFSI focus ⚠️: US concentration |

| Persistent | ₹5,000 | 82,188 Cr | 18.8% | 20% | 50+% | 0.07 | Very Strong | US 50% EU 20% IN 30% |

Product Engineering AI/ML |

AI ML |

✅: Strong growth ⚠️: High expectations |

| Coforge | ₹4,080 | 97,007 Cr | 15% | 30% | 35% | 0.07 | Solid | US 55% EU 35% IN 10% |

Cloud Solutions DI Platform |

Cloud Travel Tech |

✅: Niche expertise ⚠️: Forex risks |

| Tata Elxsi | ₹13,000 | 85,000 Cr | 25% | 30% | 80+% | 0.00 | Strong | US 50% EU 30% IN 20% |

EV Software 5G Tech |

Auto Tech IoT |

✅: EV/ADAS leadership ⚠️: Auto cyclicality |