Oklo: The Future of Nuclear Power?

Nuclear energy is once again popular, and Oklo Inc. is at the forefront. But with no revenue and big price swings — is it all hype or the real deal?

What is Oklo?

“Our mission is to provide reliable, affordable, carbon-free energy to all.”

— Jacob DeWitte, CEO of Oklo

Nuclear Energy Startup Comparison

| Company | Reactor Technology | Market Position | Key Metric |

|---|---|---|---|

| Oklo Inc. | Fast Fission SMRs |

|

⚡ Licensing Progress |

| NuScale Power | LWR SMRs |

|

📉 Public Listing |

| TerraPower | Natrium Reactors | Private (Gates-backed) | 💰 Private Funding |

| X-Energy | Xe-100 Pebble Bed | DOE Funded | 🏛️ Government Support |

Oklo's Competitive Advantages

🚀 Fast Reactor Deployment | 🤝 NRC Partnership | 🔋 24/7 Clean Power | 🏭 Factory-Built Design

Oklo Financial Dashboard

Core Financials

| Market Cap | $2.8B |

| EPS (TTM) | -$0.74 |

| Revenue | $0 (Pre-revenue) |

| Net Income | -$73.62M |

| Cash Flow (Q4) | -$13.54M |

| Debt-to-Equity | 0.01 |

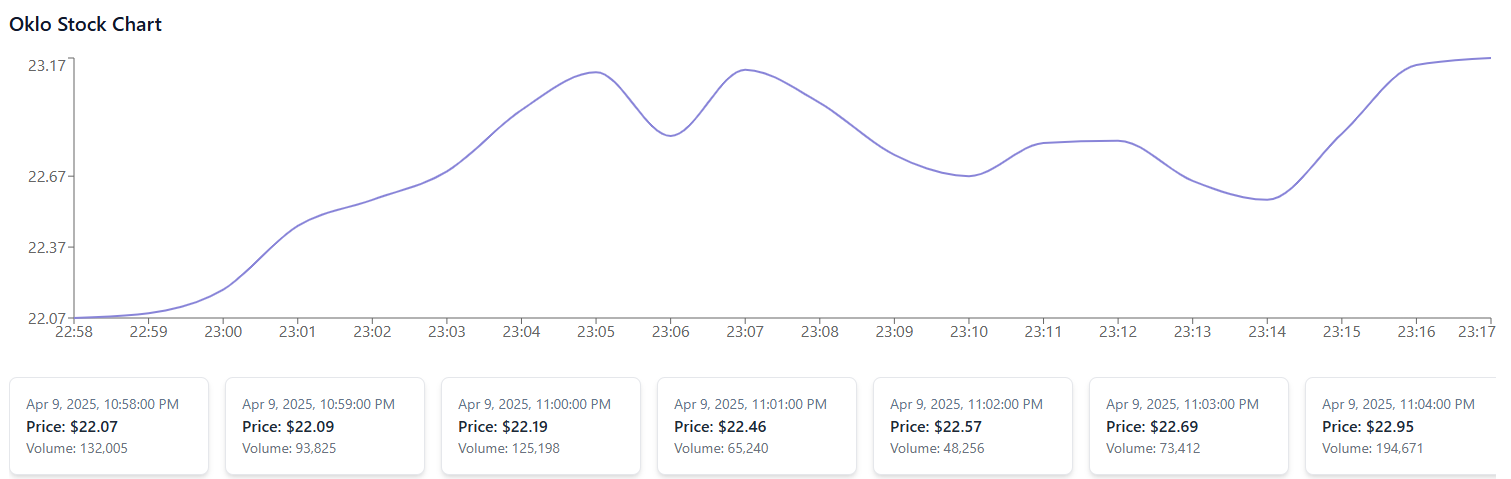

Stock Trends

| 1 Day | +19.03% |

| 6 Months | +150.57% |

| YTD | +13.42% |

| 1 Year | +159.53% |

| All-Time | +140.80% |

Trading Status (April 10, 2025)

Financial Health and Stability

Oklo’s stock performance is good, but its finances show nascent threats.

- No income

- High operating expenses

- Large R&D expenditures.

- High debt but low cash burn

Despite the losses, the analysts are upbeat, with a median price target of $47.50 (nearly 2x return from current levels).

Market Opportunity: The Rise of Nuclear

Why Nuclear Now?

- International drive to go zero-carbon energy

- Grid reliability amid rising demand

- Governments like non-intermittent sources

The Inflation Reduction Act (IRA) and DOE subsidies provide billions of dollars to subsidize companies such as Oklo to develop and build clean technology.

Government Regulation & Support

Oklo is:

- Enrollment in DOE voucher programs

- Had interface contracts with U.S. national laboratories

- Proactively navigating NRC’s advanced licensing architecture

- These steps place Oklo ahead in a regulatory-heavy market.

Risks to Consider

Challenges Ahead

- No commercial product available as yet

- Regulatory delays are the standard in nuclear

- Renewables competition + battery storage High costs of borrowing money for long projects. Case Study: Decades of delay and increased costs put NuScale’s reactor in jeopardy.

Oklo Stock Forecast & Investment Outlook

📅 2025–2026 Outlook

- Q1 Earnings (May 11, 2025)

- Licensing Milestones

- Policy Shifts

Analyst Consensus

📈 2027–2030 Vision

- Commercialization Phase (2027-28)

- Global Energy Disruptor Status

- Institutional Investment Surge

- International Expansion

Conclusion: Should You Invest in Oklo?

Advantages

- Technological superiority

- Low debt

- Sustained market drive

Cons

- No income yet

- Long journey to profits

- Regulatory barriers

Last Takeaway:

Oklo stock prediction indicates wild upside — but for the fearless. Do your own research, keep an eye on news updates, and dollar-cost average if you do choose to invest.