Understanding the Indices: Russell 3000 and S&P 500

The Russell 3000 Index is a broad-based stock market index that represents around 98% of the investable U.S. equity market, including small, mid, and large-cap stocks. It is made up of the Russell 1000 (large-cap) and Russell 2000 (small-cap) indices.

The S&P 500 contains 500 of the biggest stocks listed on U.S. exchanges and represent about 80% of the combined value of the U.S. market. While it contains fewer firms, it contains bigger companies that have been able to survive the long term.

Index Comparison Dashboard

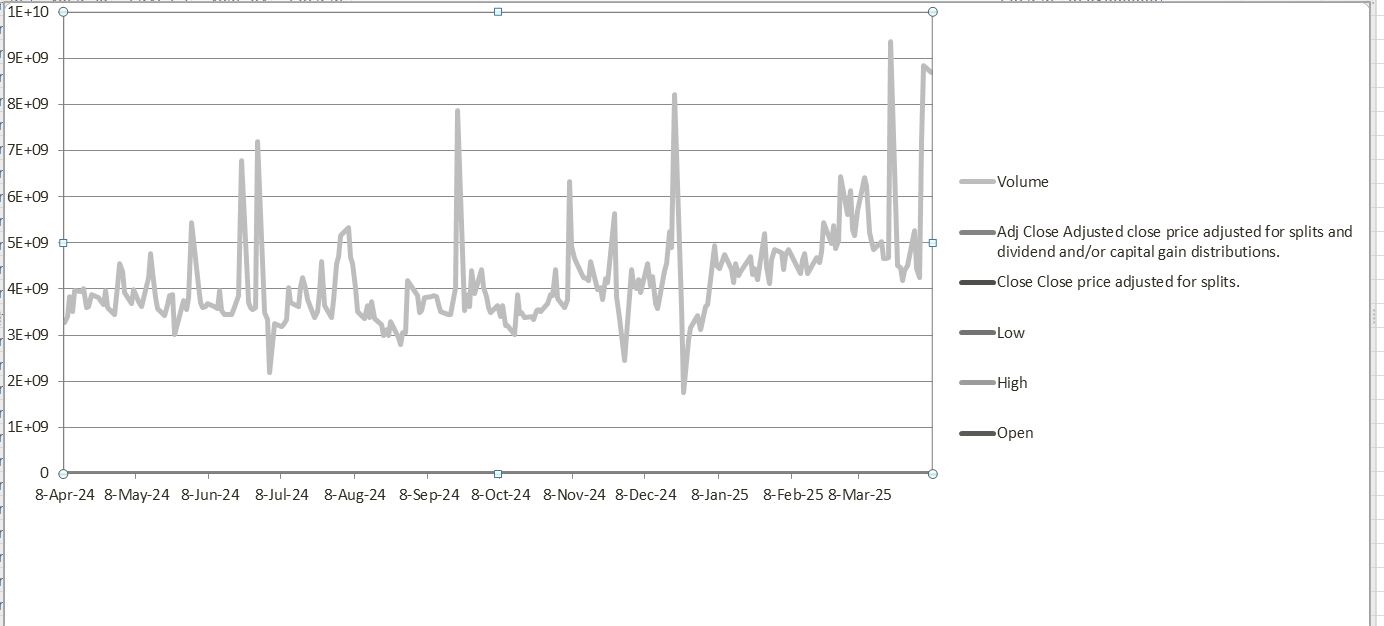

Russell 3000 (IWV)

S&P 500 (^GSPC)

Key Statistics

| Metric | Russell 3000 | S&P 500 |

|---|---|---|

| Previous Close | 287.37 | 5,074.08 |

| Open | 277.23 | 4,953.79 |

| Volume | 724,877 | 6.24B |

| PE Ratio (TTM) | 21.65 | N/A |

| Yield | 1.16% | 1.37% |

Historical Performance: Russell 3000 vs. S&P 500 Returns

Both indices have done well historically, but the two are comparable but slightly different. Based on iShares Russell 3000 ETF (IWV) and S&P 500 (^GSPC) data:

- Russell 3000 5-Year Return (2025): around 73.41%

- S&P 500 5-Year Return (as of 2025): around 79.47%

Although the S&P 500 has surpassed the Russell 3000 in the past five years, the broader exposure of the Russell 3000 gives investors access to high-growth small-cap stocks that the S&P 500 does not.

Volatility vs. Risk: How Are They Different?

- The Russell 3000 would experience more swings because it includes small companies. Small companies would be impacted more by economic swings.

- On the other hand, the S&P 500 is more balanced because it only includes strong companies that have a good history.

- If you would prefer to play it safe, the S&P 500 would be preferable to you, while those wanting higher potential for upside would choose the Russell 3000.

Russell 3000 vs S&P 500 Growth (2020–2024)

Expense Ratios and ETFs: IWV vs SPY

- iShares Russell 3000 ETF (IWV): 0.20% fee ratio

- SPDR S&P 500 ETF (SPY): Cost ratio 0.09%

- SPY is less expensive than Russell 3000 and S&P 500 ETF, particularly for long-term investors.

Global Considerations: Does an S&P 500 ETF Trade in India?

Right! Indian investors can take exposure to the S&P 500 in the form of mutual funds and ETFs like:

- Motilal Oswal S&P 500 Index Fund

- Nippon India US Equity Opportunities Fund

- And yet, few Indian options are available for exposure to Russell 3000. This makes the S&P 500 a preferable global index to access for Indian investors.

Frequently Asked Questions

📈 Russell 3000 10-Year Avg Return: ~10.6%

📊 S&P 500 10-Year Avg Return: ~10.5%

✅ Conclusion: Both indexes have shown strong historical performance.

✅ Final Verdict: Russell 3000 vs S&P 500 — Who Wins?

If you want simplicity, stability, and tried-and-true returns, then the S&P 500 is the best. But if the objective is full market exposure with a bias to innovation and growth, then the Russell 3000 is an attractive alternative.

In 2025, smart investors are diversifying their investments to achieve stability and growth. For S&P 500 and Russell 3000, the best option might be to use both of them together instead of just one!

Bonus: Why This Comparison Is More Important Now Than Ever Because the economy keeps moving forward, with more technology and more private investor control, the debate between the Russell 3000 and the S&P 500 is highly relevant today. Getting it right today could translate into enormous profits in the next 5 to 10 years.

Pingback: RGTI Stock Forecast 2025: Buy or Avoid This Pick?